Amortization of assets calculation

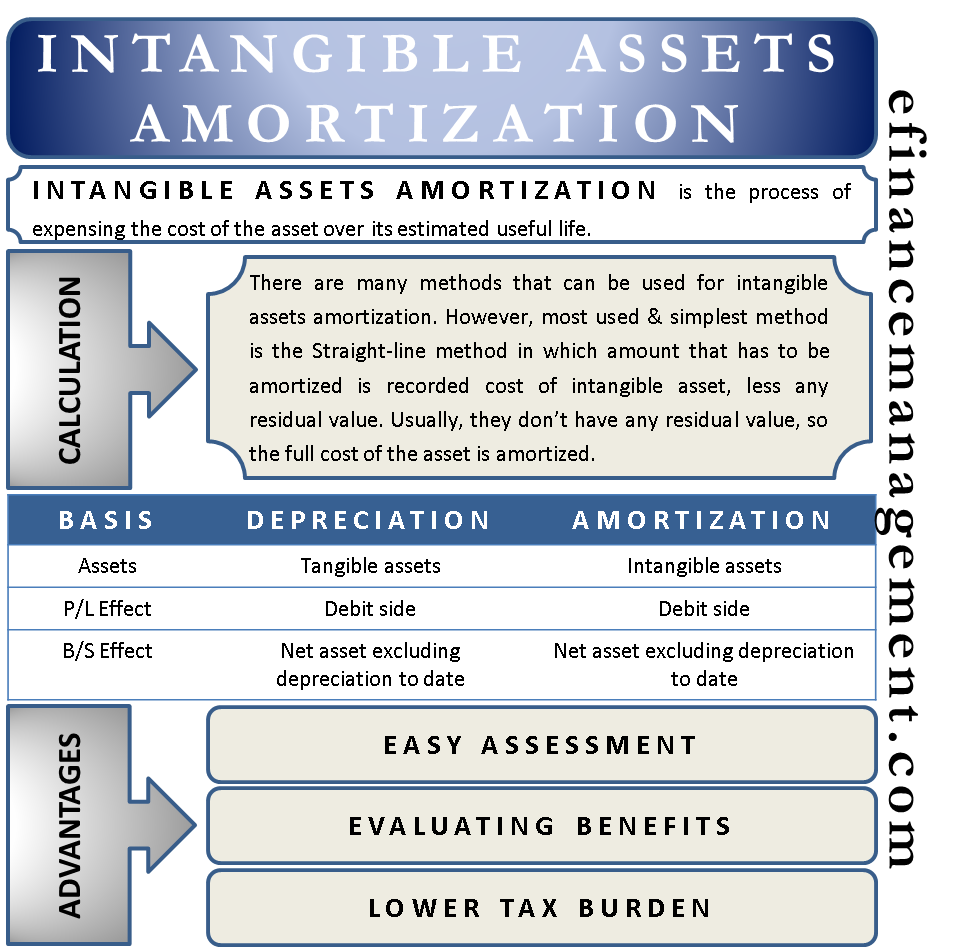

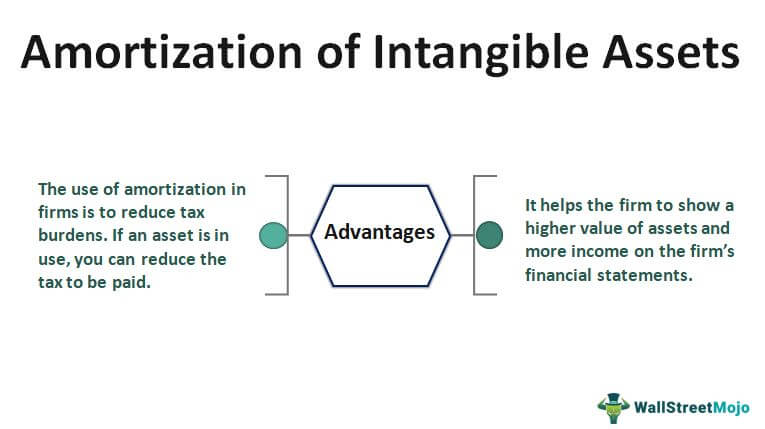

In accounting amortization refers to the process of expensing an intangible assets value over its useful life. It is comparable to the depreciation of tangible assets.

What Is Amortization Bdc Ca

Calculating EBITDA Calculating EBITDA involves.

. The amortization expense can be calculated using the formula shown below. The company should subtract the residual value from the recorded cost and then divide that difference by the useful life of the asset. In other words it is spreading out loan payments over a.

Amortization Calculator - Amortization Schedule Calculator. If useful life is not correct the amortizing cost. Amortisation refers to the routine decline in value of an intangible asset over time.

There is yet another method but it is not so common. Each year that value will be netted from. Below are the few disadvantages of amortization of intangible assets.

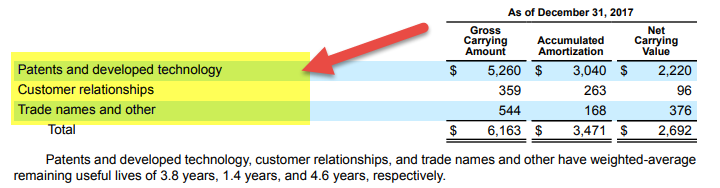

To calculate the value of assets we use two approaches- One is Depreciation and the other one is Amortization. In the assets section you can make both monthly and annual amortization. For intangible assets with an indefinite life that were acquired rather than created by your business the amortization period should be 15 years per the IRS.

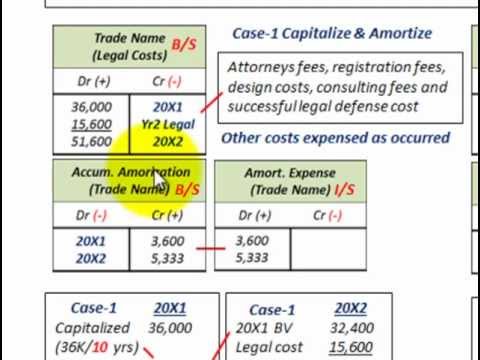

Straight-Line Amortization Formula Amortization Expense Historical Cost of Intangible Asset Residual. The amount of amortization every year is given by. It is also used to describe the repayment of a loan or finance agreement over a period of time.

It is difficult to calculate the useful life of an intangible asset. Amortization Book Value Residual Value Useful Life Uses of Amortization of Intangible Assets Amortization of intangible assets can. The formula to calculate amortization is Cost of an asset Residual value Useful life of the asset.

Holded will take into account the type of amortization when generating the table and the corresponding entry. Recall that amortization in EBITDA involves expensing intangible assets rather than tangible assets over their useful life. Guidance is provided by accounting and tax rules on how to calculate the depreciation of the assets over.

The loan amortization calculator generates an amortization table that shows the principal interest total payment. In the case of intangible assets amortization refers to the act of depreciation. Amortization Definition Amortization is a strategy that is used to gradually reduce the value of a loan or intangible asset over a period.

Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for.

Amortization Of Intangible Assets Formula And Calculator Excel Template

Amortisation Double Entry Bookkeeping

How To Amortize Assets 11 Steps With Pictures Wikihow

What Is Amortization Definition Formula Examples

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Formula And Calculator Excel Template

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Options For Intangible Assets Valued Using The Income Approach Ds B

Intangible Assets Amortization All You Need To Know Efm

Amortization Of Intangible Assets Definition Examples

Amortization Of Intangible Assets Financiopedia

How To Amortize Assets 11 Steps With Pictures Wikihow

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Formula And Calculator Excel Template

Amortization Of Intangible Assets Definition Examples

Amortization Vs Depreciation Difference And Comparison Diffen

Intangible Assets Accounting Limited Life Amortization Impairment Testing Recording Youtube